The Basics

1. My Profile

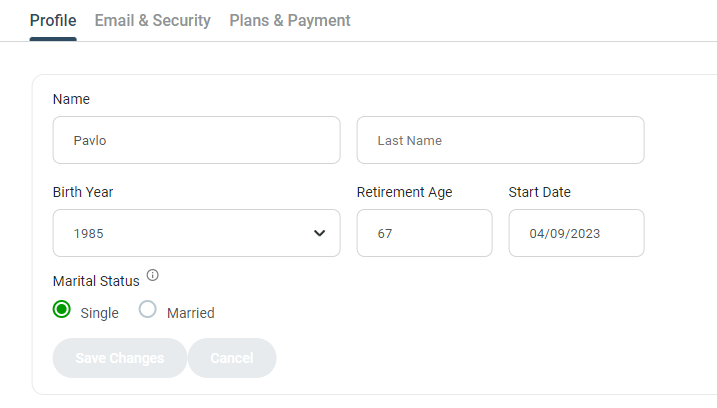

Profile Settings can be found by clicking on the Menu button in the top right corner and choosing Profile.

The First Name and Last Name fields are universal to your account. Other settings discussed here are specific to each of your scenarios.

The Start Date of your trajectory defaults to the date you created your profile. This is done so that income, expenses, and gains can be correctly prorated during the first year. For example if you start in June, we will only add 6-months of income to your model. If you wish to change this value to start at the beginning of the year, simply change it here.

Your Birth Year was also entered when first completing your initial set-up. OnTrajectory does not collect an actual birthdate, therefore ages are based on the age you turn in any given year.

The Single / Married designator is used to determine U.S. Federal Tax Rates and the amount deductible when selling a primary residence.

2. The Assumptions Bar: Retirement Age, Trajectory End Age, Inflation Rate

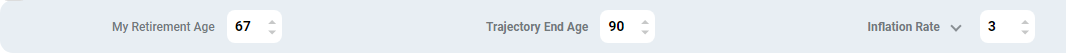

With the Assumptions Bar enabled, three key settings are located on the bar in the middle of the screen, so that they can be easily changed at any time:

Three key settings are located on the bar in the middle of the screen, so that they can be easily changed at any time:

Retirement Age — The age at which you plan to 'fully' retire. We place an orange 'R' on the graph to mark this age, and it is also used when entering an 'R' in age fields. See the section below, Centralized Retirement Age for more information.

Trajectory End Age — This is the final year in your Trajectory, however this value may be extended past your assumed 'demise' to allow for additional years to be modeled. Doing so is particularly helpful when modeling scenarios that include a younger spouse — simply set this number to include additional years and then set the End Age on individual Income / Expense items, as appropriate.

Inflation — This is a central rate used to inflate Incomes, Expenses, and Contributions, by default.

It is also used when viewing amounts in Today's / Tomorrow's Dollars. Today's Dollars means that the effects of inflation are included when looking at a number and represents the buying power of that amount TODAY. For example, $100 today will buy less in 30 years — at 2.5% Inflation, you would have to spend $243 in TOMORROW'S dollars to purchase the same amount of product.

In addition to inflating the future, by default, we automatically "deflate the past" and base all dollar amounts on the current year. While this may seem conunter-intuitive at first (because it does cause past "real" dollars to be automatically adjusted) from a modeling perspective, it produces more accurate results as the age of your model goes beyond year 1.

If OnTrajectory did not deflate past amounts, it would cause a "pop" in your Trajectory End Balance whenever you crossed from December 31st to January 1st due to "losing" a year of inflation. That said, you can turn off this option by going to Menu / Calculation Options and deselecting "Deflate past Income, Expenses & Contributions". Please note that the Calculation Options feature is only available in the Unlimited View.

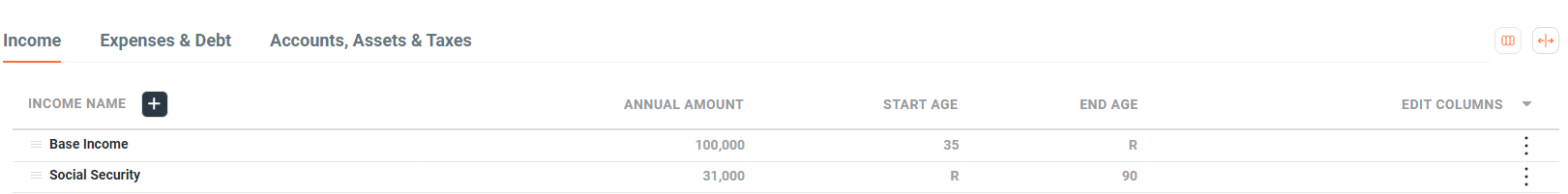

3. Income

On Trajectory generates two "Income Items" (note that income is always entered as gross/pre-tax income) — the first from your Current Age to your estimated Retirement Age, and the second from your Retirement Age to the Trajectory End Age. The Income 'Amount' for the second item is a VERY rough estimate of your Social Security benefits (see the example below).

You can (and should) change the Amount in your Social Security estimate based on your actual situation. SSA.gov is a great place to get more accurate estimates of your Social Security benefits.

There's much more to say about Modeling Income, including how to show other Income streams (from a spouse, for example) — or how to account for Income Taxes and annual raises. See the Modeling Income Guide for more information on these and other income-related topics.

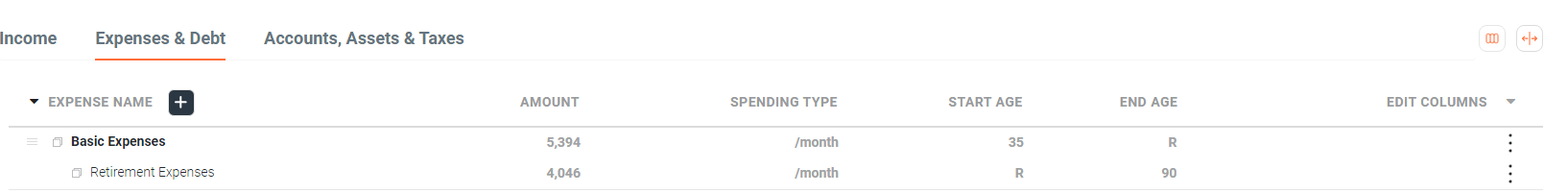

4. Expenses & Debt

For your default Expenses, the On Trajectory generates a single item, with 2 Age Ranges. Age Ranges are a handy way of defining a single item that changes over different parts of your life. In this example, the first Age Range spans until your estimated Retirement Age, and the second goes from Retirement Age to the End Age of your Trajectory, as illustrated below:

Why use Ranges rather than creating separate Items? Because ranges prevent you from accidentally overlapping Ages, and it makes "what-if" analysis far easier when your Trajectory becomes more complex.

On Trajectory calculates the Expense Amount in the first range by subtracting your monthly savings from your monthly income. The second range is simply a 15% reduction of those expenses (since most folks spend less during their Retirement years).

Again, these are merely estimates to get you started. There's much more to know about Expenses, so do read the Modeling Expenses Guide.

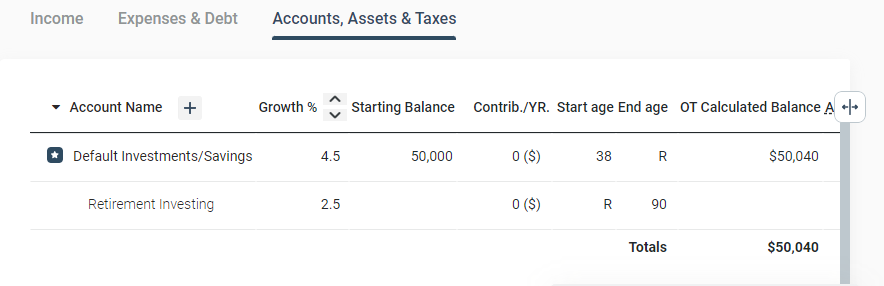

5. Accounts, Assets & Taxes

Like Expenses, we model a Default Investment Account for you with two Age Ranges. The first range has a slightly higher % Growth rate than the second range. This reflects the common practice of investing more conservatively after Retirement (as illustrated below).

Again, why use Ranges rather than creating separate Items? Because Ranges prevent you from accidentally overlapping Ages and it makes "what-if" analysis far easier when your Trajectory becomes more complex.

Now, in reality, you probably have funds in both low-interest accounts (like checking/savings accounts) and higher- yielding accounts — both taxable and tax-deferred (such as an IRA or 401k). As elsewhere, you should model your accounts to reflect your unique financial situation.

The Default Investment Account cannot be deleted (because you always need a "place" to deposit funds whenever Income is greater than Expenses). The % Growth for the 'Default Account' represents the rate-of-return you expect on your investments generally (often placed in a taxable mutual fund or brokerage account).

As with Income and Expenses, there is alot more to learn about modeling Accounts. See the Modeling Accounts Guide for more information.

6. Actions: Adding Items, Columns, Ranges, Hiding & Reordering

Adding Items

To add a new Item, click the "Add" button (see screenshot below)

A menu will appear on the right side of the screen. Select the items you would like to add and press Add All Selected Items.

Edit Columns

For the Income and Expenses table, you can choose to add ‘Growth Override %’. This feature allows you to specify the rate at which an income item is expected to grow. By default, Income (and Expenses) grow at inflation, however, you can override that rate by clicking the checkbox in this column to indicate a specific growth percentage. More information on Growth Override % can be found in the Modeling Income Guide.

For the Accounts table, you can choose to add ‘Contributions’ or ‘Tax %’. Contributions allow you to designate how much money you would like to contribute to any account listed. Note that you do not have to add contributions to the Default Investments account unless you would like to. Any excess cash that is left over after paying for expenses and contributions to other accounts will automatically go into this account.

For 'Tax %' we default to 'auto', meaning both your Income and Gains taxes are calculated automatically for you for each year of your model. If, however you wish to manually enter your Effective Tax Rate, you can do so. See Modeling Taxes for more information.

In addition, when you designate contributions that typically occur "pre-tax" (such as those to a 401K or Traditional IRA), OnTrajectory automatically excludes those contributions from taxable Income — meaning you needn't adjust your tax-rate to see the tax benefit of making those contributions.

Three Dots Menu

For every item added under Income/Expenses/Accounts, there is a three dot menu available which contains additional options. For the Income and Expense tables, the following features are available:

- Add an age range: allows you to enter multiple age ranges for a specific item

- Exclude/Include from Calculations: will remove that item from the On Trajectory calculations. To add the item back, choose Include. This is an easy way to model certain "what-if" scenarios and quickly judge the impact of including / excluding the long-term financial impact of an item.

- Hide in Table: This will remove the item from the table, but On Trajectory will still use the data in the calculations. The hide feature is mostly used when an item is no longer in use but the user doesn’t want to delete it all together. To unhide an item, click the eyeball icon in the top right corner.

- Delete: Will remove the item from the table and the data will also be removed from the calculations.

- Show/Hide on Chart: This will specifically show an item on the On Trajectory chart.

- Add Spouse Information: This will allow you to enter your spouse’s name, birth year and retirement age.

The Accounts table has one additional option in the three dot menu:

- Link to bank account. This feature allows you to link your On Trajectory account to a third party financial account to pull in data automatically. More information on this can be found at Tracking Progress and Linking Accounts.

Reorder Items

If you wish to reorder some of the items in Income/Expense/Accounts, you can do this by clicking and

holding the ![]() icon and

move the item to the desired position.

icon and

move the item to the desired position.

Undo Button

If you wish to undo a previous action, click on the Undo button located in the top right corner of the website.

7. Centralized 'Retirement Age

Rather than entering a discrete value for your Retirement Age, such as '67' in an Income, Expense, or Account item — you can enter 'R' to represent your retirement age.

In the example below, notice the End Age for Base Income and the Start Age for Social Security are both set to 'R'. Since Retirement Age is '67', and since ranges cannot overlap, when R is used as an End Age, it is translated as Retirement Age minus 1-year. Think of it as the item ending at the beginning of your Retirement period. Therefore, Base Income's End Age is interpreted as '66' (the last year before retirement begins).

The 'Retirement Age' and 'Inflation Rate' fields are located just above your Income, Expense & Account data. Changing your Retirement Age here will universally change the value everywhere the 'R' is used — making 'what-if' analysis easier than ever before.

8. Calculate Chance of Success & End Balance

Your 'Chance of Success' (located on the top right side of the chart) automatically runs both Historical and Monte Carlo analysis on your inputs. OnTrajectory then averages the results and displays your 'chance of success'. The percentage represents the number of simulated Trajectories that result in an end amount above 0. The End Balance is what On Trajectory is calculating will be your final end balance based on the data input you have provided (income, expenses, account growth rates, etc..)

It is important to note that this percentage is NO GUARANTEE of success in your investments, and successive runs may vary due to the random nature of Monte Carlo analysis — usually +/- 3%. Finally, NO information provided by OnTrajectory should be considered investing advice. All financial information is solely for educational purposes. Please see your own professional for personal investment advice.