Modeling Taxes

OnTrajectory provides a variety of mechanisms and techniques for modeling the effects of taxes over your financial life. However, it's important to always consult a tax professional when dealing with such complicated and technical subjects. Tax laws and your personal tax situation may change. You should not depend solely on this tool for accurate projections of tax-handling and the effects of taxes when making long-term financial decisions. Do not use this tool to calculate taxes or for tax reporting purposes.

1. Taxes on Accounts & Incomes

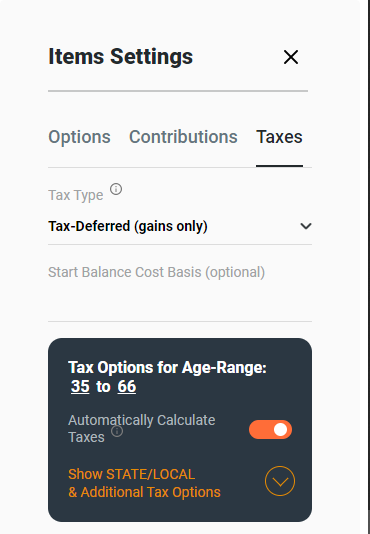

To access Taxes, click on any account row and select Taxes from the 3rd tab shown.

Your 'Default Account' contains your Effective Tax Rate and is used to tax both income and gains (unless you specify a separate Gains Rate, as discussed in the section below).

Your Effective Tax Rate is the actual amount you pay in taxes for a given year and is not truly known until you have calculated taxes/refunds for that year, although you can get a good idea of your typical Effective Tax Rate by looking at past returns.

For example, if you make $40,000 per year, and your employer withholds 25% — but you subsequently receive a $2,000 refund, here is your Effective Rate:

- 10,000 (withholding) minus 2,000 (refund) equals 8,000

- divide that by 40,000 (salary) and your rate equals 20%

In addition, when you designate contributions that typically occur "pre-tax" (such as those to a 401K or Traditional IRA), OnTrajectory automatically excludes those contributions from taxable Income — meaning you needn't adjust your tax-rate to see the tax benefit of making those contributions.

Cost Basis — The cost basis is used to determine the amount of untaxed gains in an account when it's first defined. Typically, this is significant if you have a large account with sizable prior growth, such as a brokerage account for which you have not paid taxes on the growth. This option is only available for accounts with Tax Type 'Tax-Annual' or 'Tax-Deferred (gains only)'. For more information on Tax Types, see the following section.

NOTE: If no cost basis is entered, the Starting Balance is used as the cost basis. In addition, for all account types except Home/Rental Equity, the cost basis is limited to the starting balance of the account.

Again, it is your 'Default Account' where you centrally define Tax Rates universally for any given year.

2. Tax Types

The tax Type dropdown contains the following options:

- Tax-Annual — Allows you to define a Dividend Yield, used to compute an amount to be taxed annually each year. Remaining gains are treated as Tax-Deferred. If the Dividend Yield is left blank, all gains will be taxed annually each year.

- Tax-Deferred — not taxed until withdrawals occur (i.e. Required Minimum Distributions, rollover, draw-down, conversion). The entire amount is taxed at the Effective (Income) Tax Rate based on the assumption that contributions occurred pre-tax. This is the default for "Traditional" 401k and IRAs. There are two other types of Tax-Deferred designations, listed below.

- Tax-Deferred (gains only) — not taxed until withdrawals occur. Only gains are taxed based on the assumption that contributions occurred post-tax. This is the default for Brokerage and Mutual Fund accounts; however, if you are taking significant dividends each year, you may consider using "Tax-Annual".

- Tax-Deferred (contributions only) — not taxed until withdrawals occur. Only contributions are taxed based on the assumption this is a conversion from an account with pre-tax contributions.

- Tax-Exempt — no taxes deducted.

- Tax-Roth — the default for Roth-IRAs and Roth-401Ks, it enforces rules specific to Roth accounts. If funds are withdrawn before age 60, contributions are taken first to avoid paying taxes on gains and triggering Early Withdrawal Penalties. No taxes are paid on withdrawals age 60 and after.

For information on the default tax-type for each type of account, see Guide 4. Modeling Accounts.

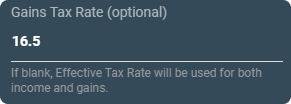

3. Gains Tax Rate

If entered, this rate is used to calculate taxes on gains when withdrawing funds from an account that is Tax-Deferred (gains-only) or Tax-Deferred (contributions-only). If no value is entered, then the Effective Tax Rate is used to tax the gains.

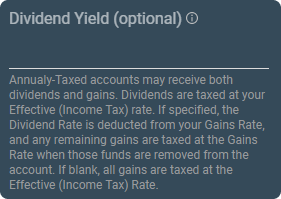

4. Dividend Yield

If entered, this rate determines the portion of gains that are taxed annually at the Effective (Income) Tax Rate. For example, if an account’s growth rate is set at 5% and Dividend Yield is set at 2%, then 2% will be taxed each year. The remaining 3% (the remaining gains) will only be taxed when funds are pulled from the account.

If this value is left blank, ALL annual gains are taxed at the Effective (Income) Tax Rate. In other words, if there is no dividend yield set, all gains are treated as dividends (i.e. zero capital gains) and taxed at the income tax rate every year. If you wish ALL growth to be taxed as gains (upon withdrawal), select the tax type "Tax-Deferred (gains-only)."

Note: Dividend Yield is only available on accounts with the Tax Type "Tax-Annual". If no value is entered, ALL gains in the account are taxed each year.

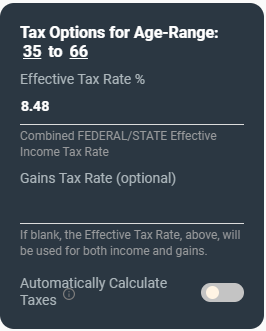

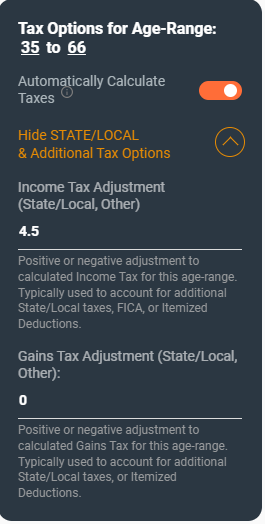

5. Automatically Calculate Tax Rates

Select Automatically Calculate Taxes to have OnTrajectory estimate a hypothetical federal & state tax rate for future years. This estimate is based on Total Taxable Income for each year, including:

- All Income Items for the year

- Required Minimum Distributions (RMDs)

- Drawdown Withdrawals

- Defined Taxable Withdrawals (negative contributions)

- Annually Taxable Gains

- Conversions to a Roth Account

- Taxable Rollovers

- Adding in a state tax of 4.5%

If Total Taxable Income is greater than Expenses for the year, we subtract the standard deduction (either single or married) and determine the tax rate based on U.S. Federal Marginal Rates and any Tax Adjustment you may have defined.

For clients that are on the Unlimited plan, they can check each year’s tax rate by accessing the Output Data feature.

Adjusting the Automatic Tax Calculation

Further configuration of your tax-treatment is available from the Additional Options section as shown below:

Income and Gains Tax Adjustments — These can be either positive or negative values and are applied to your Automatically Calculated Rate(s). Most often, this is used to represent additional State or Local taxes, FICA, OR to potentially lessen your tax burden as a result of itemizing your deductions. Again, everyone's taxes are unique and OnTrajectory is not able to provide tax planning advice.

6. Non-Centralized Tax Rates

Centralized versus Non-Centralized Tax Rates — By default, OnTrajectory maintains "centralized tax rates" meaning; any given year, the same tax-rates are applied to every Income and Account item. Should you wish to set different rates for different items, you may do so from Menu / Centralized Tax Settings (although this is NOT typically used).

NOTE: If Non-Centralized Tax Rates is selected you will have to separately set taxes for EVERY income and account item, otherwise no taxes will be taken on those items.