Dealing with Debt (Available in Unlimited Plan)

1. Associating Debt to an Expense

There are 2 ways to define debt in OnTrajectory, either through an Expense or through a Home Equity Account. For debt that is related to expenses like credit cards bills, personal loans, student loans, or other types of debt that don't build equity (like a home or a rental property).

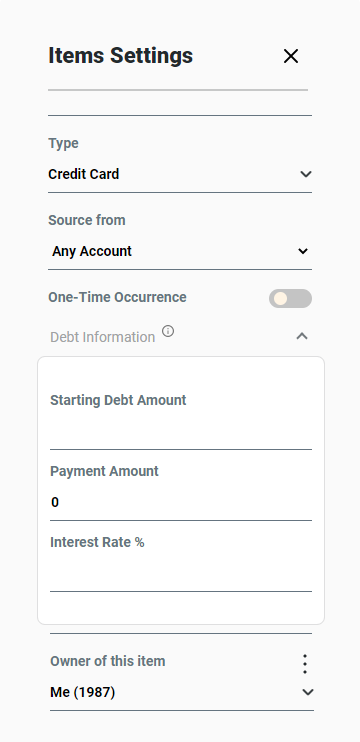

After creating an Expense, click the wrench icon to optionally associate that expense to an amount of debt and the annual interest rate on that debt, as shown below:

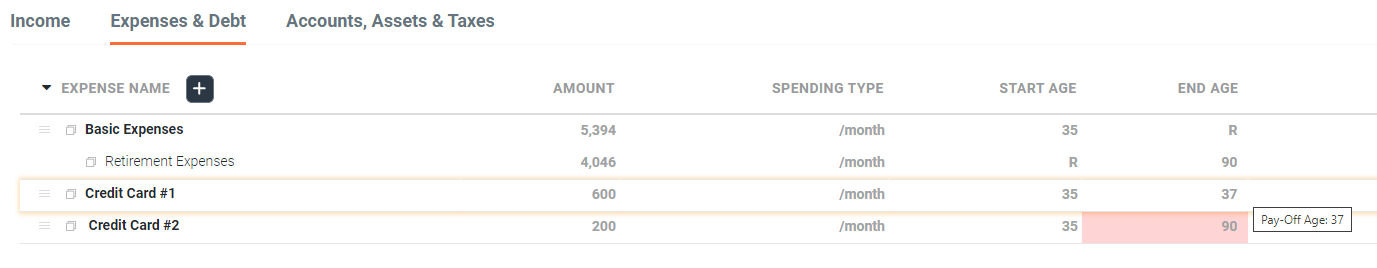

If you set a Starting Debt Amount for an expense, THE EXPENSE IS INCURRED ONLY UNTIL THE DEBT IS PAID-OFF. As long as the expense consists of a single age-range, OnTrajectory will automatically update the End Age based on the year the debt is paid-off. If there are multiple age-ranges for the expense, you can see the pay-off age by hovering over the End Age field (which is also highlighted in gray). Finally, if a debt is never paid-off based on the expense Amount you have entered, the End Age field is highlighted in red

Each year a debt is not paid-off, it accrues interest against that debt at the beginning of the year. Even though this is a slightly "pessimistic" view of your debt situation, taking this approach ensures our calculations will not create false assumptions about when a debt will be fully paid-off.

2. Equity Debt (Home Equity and Rental Properties)

Not all debt is the same — when you pay-off debt such as the mortgage on your home or the loan on a rental property, you accrue significant equity, which OnTrajectory allows you to track and include in your financial life-plan. For more information on Home Equity, see the guide: Modeling Home Equity

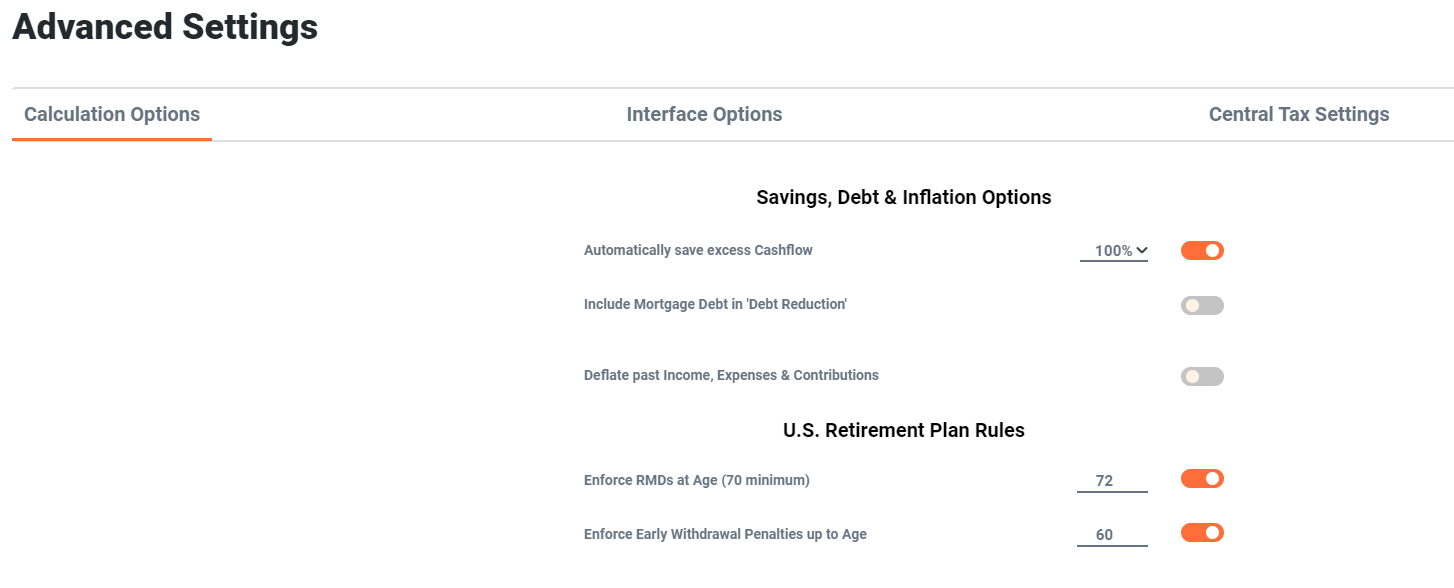

By default, this kind of debt is NOT included when employing one of the "Debt Reduction Strategies", as discussed below. To include mortgage/equity debt, go to Menu / Settings / Calculation Options and select "Include Mortgage Debt in Debt Reduction" — as shown below:

3. Snowballs versus Avalanches

You can leverage 2 popular "Debt Reduction Strategies" in OnTrajectory: Snowball or Avalanche. A Snowball strategy uses any excess cash flow to automatically pay-down existing debt with the lowest balance first. Once that debt is paid off, those funds are applied to the next highest debt, etc — until all debt is paid off.

Avalanche, on the other hand, focuses all available cash flow on the debt with the highest interest rate first. Although in most situations, the avalanche method may save you slightly more in the long run, psychologically it's often preferable to employ snowball because you get a great feeling by paying off those smaller debts first!

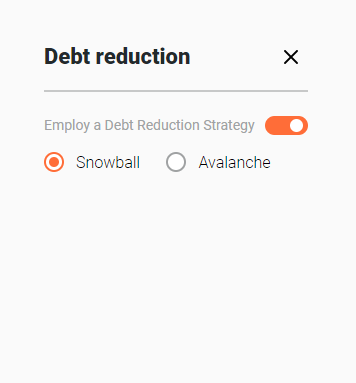

To experiment with these strategies, select Debt Reduction from the Strategies drop-down menu and select the option you wish to use, as shown below.