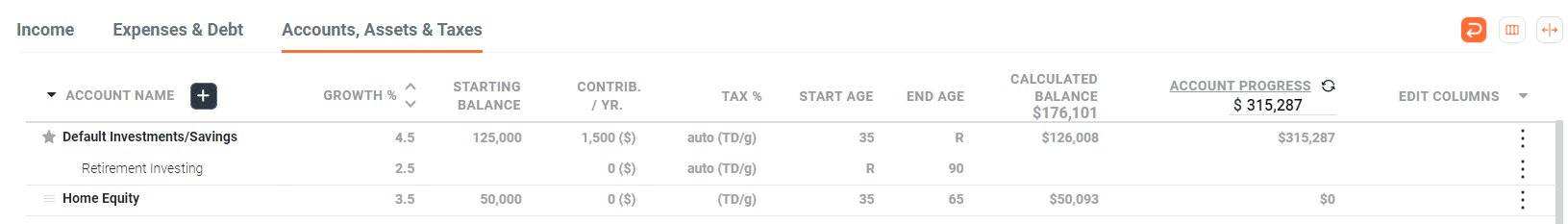

Modeling Home Equity (Available in Unlimited Plan)

For many people, the equity they've built (or are building) in their home is a significant portion of their overall savings/investments — modeling it, however, can be tricky... until now.

1. Entering Loan / Mortgage Information

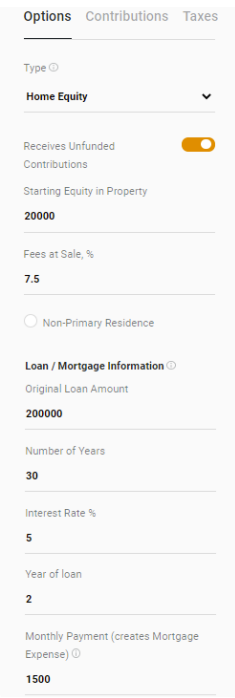

When you add a new 'Home Equity' item from the Accounts & Taxes tab, the Item Properties window will automatically appear, as shown below:

- Starting Equity in Property — If there is a loan associated with the property, use the amount of

equity at the time of purchase — for example, if there was a significant down-payment on the

property there will be equity in the property right away. If there is no loan associated with the

property, simply use the current value of the property.

(NOTE: If there is no loan associated with the property, consider setting the 'Cost Basis' on the Taxes tab to more accurately calculate taxes when selling the property) - Fees at Sale — percentage of the sale price to deduct agent fees and/or other closing costs. The amount appears as a negative 'Defined Contribution' on the account's output data.

- Non-Primary Residence — by default, a property is considered your primary residence and receives a tax deduction on gains at sale (based on being either married or single). If this is not your primary residence, check this box so that the deduction is not applied.

The following values are optional and only apply if you have a loan on the property.

- Original Loan Amount — the original amount of your loan (i.e. not adjusted for inflation).

- Number of Years — the length of your loan, typically 30 or 15 years.

- Interest Rate — the interest rate on your loan.

- Year of the loan — If you are already into the term of your loan (for example, you've already paid 5 years on your 30-year mortgage), enter the number of years you have already paid here. The lowest this value can be is 1, which means you are currently in the first year of the loan.

- Monthly Payment — Mortgage payment INCLUDING escrows & insurance. Extra principal payments are defined on the Contributions tab. Leave blank if you do NOT wish a Mortgage expense item to be automatically added in the Expense table.

After entering the values above, click 'OK' to calculate your equity over time. Principal accrues based on a standard amortization schedule, and you can see those values in the Defined Contributions column on the account's output data.

If you entered a Monthly Payment, a 'Linked Mortgage' expense will automatically be added to the Expense table. The amount of this expense is the sum of the Monthly Payment and any additional principal contributions you may have defined on the Contributions tab.

NOTES REGARDING LINKED MORTGAGES: The 'Expense Amount' and 'Start/End Age' fields of a Linked Mortgage are changed from the Home Equity Account that created it. To delete a Linked Mortgage, either delete the Equity Account item or clear the Monthly Payment field. In addition, if the Home Equity item is marked as 'excluded', the linked-expense will also be excluded (although the linked-expense can be excluded independently from the equity account).

2. Modeling Starting Equity, Down-Payments, and Property Value

If you paid a significant down-payment or if this is a re-finance, then you have equity at the start of the loan. To model the value of this equity, enter the amount in the Starting Equity in Property field as described above. This value is subsequently placed in the 'Starting Balance' column for the item. Note: This is equity that exists in the first year of the loan only, regardless if the loan was begun in the past (which can be set using the 'Year of loan' field, also discussed above).

While the Interest Rate field determines the accrual of principal over the lifetime of the loan, the % Growth of the Home Equity item determines the rate of increase in the value of your home. Each year's ending balance for a Home Equity item is based on both the growth in value of your home along with the accrual of principal.

3. Making Extra-Payments

OnTrajectory allows you to model extra principal payments to your loan. Designate the annual amount of those payments as Contributions to the item. As long as you have a loan with outstanding principal, the extra-payment amount is added as an "Other Contribution" (shown on the Output Data for the account).

After the loan is paid-off, any defined extra payments (contributions) are simply not made.

4. Modeling the Sale of Your Home

OnTrajectory will never automatically "drawdown" funds that are in a Home Equity account, because those funds are not liquid. In order to 'free-up' funds, the property must be sold — which occurs based on the End Age of the account.

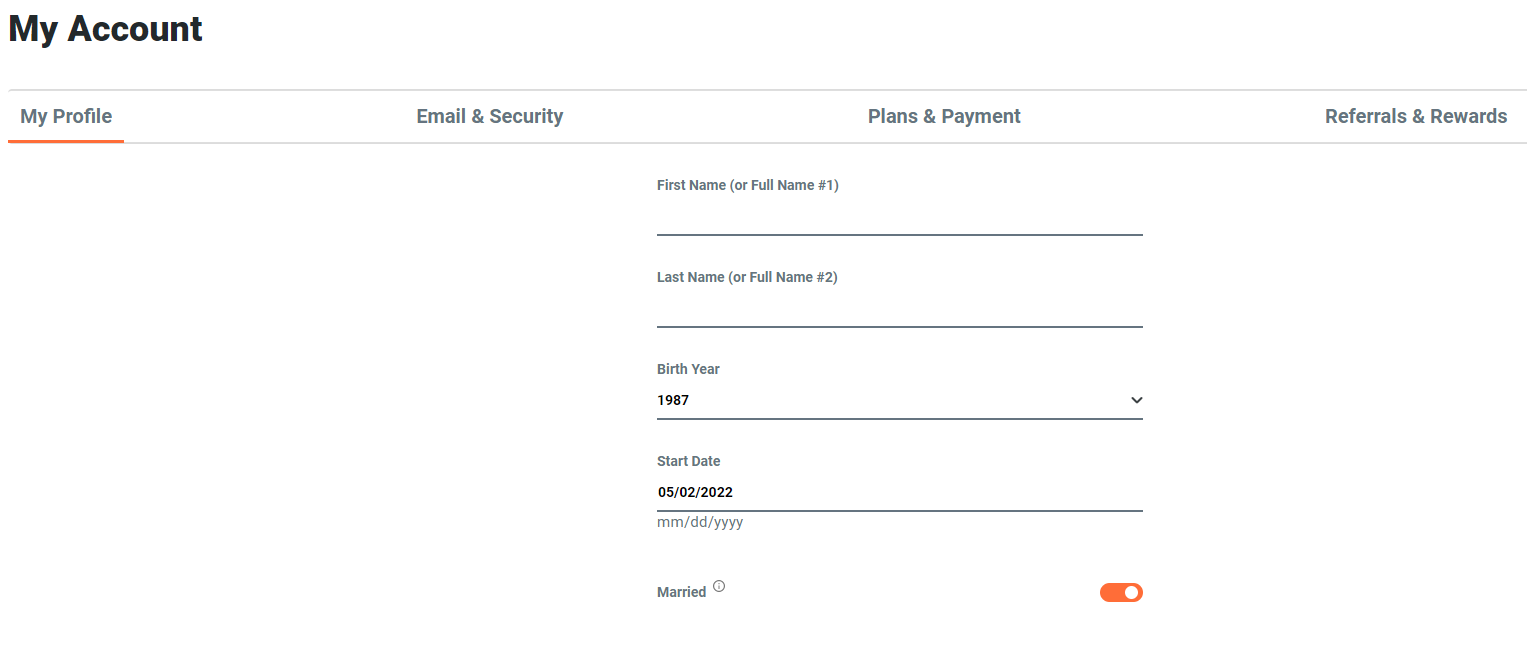

By default, the End Age of the Home Equity item is set to 30 years from the Start Age, however, it should be updated to reflect the age at which you expect to sell the property. Taxes at sale are automatically calculated based on gains in the property and the 'Single / Married' option located in My Profile settings as shown below:

If there is no loan associated with the property, set the 'Cost Basis' on the Taxes tab to more accurately calculate taxes when selling the property).

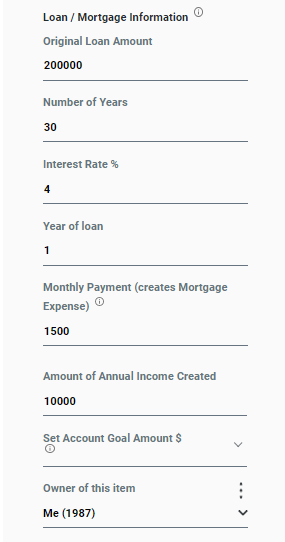

5. Modeling Rental Income

Another option unique to 'Equity' account items is the ability to define and link annual income. This feature is similar to linking a Mortgage Expense, wherein entering a value in this field causes the creation of an Income Item with the same age ranges as the Equity account.

NOTES REGARDING LINKED INCOME: The 'Income Amount' and 'Start/End Age' fields of a linked-income item are changed from the Home Equity Account that created it. To delete linked-income, either delete the Equity Account or clear the 'Amount of Annual Income' field. In addition, if the Home Equity item is marked as 'excluded', the linked income will also be excluded (although linked-income can be excluded independently from the equity account).