Viewing Output Data (Available in Unlimited Plan)

Viewing Output Data

Do you love data? Are you, in fact, a data junkie? If so, select Output Data from the Central Settings Bar

under the chart to launch a new page with five primary tabs. The tabs are labeled Incomes, Expenses,

Accounts, Drawdowns and Grand Total. Selecting a tab displays a table view of relevant data for the current

scenario. Amounts are shown in either today’s or tomorrow’s dollars based on the setting of the radio

buttons in the upper right-hand corner of the page.

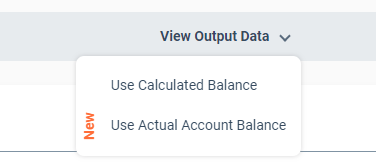

NEW! Users can now view their Output Data via OT Calculated Balances or by Actual Account Balances.

1. Incomes Tab

This tab contains data relevant to the Income item table and displays the following columns:

- Age — Your age in the corresponding year.

- Year — The year corresponding to each row in the table.

- Income Name — A column for each income stream, column headers correspond to the income's Name. The values shown are pre-tax amounts.

- Gross (pre-tax) Total Income — Total Income for the year (pre-tax).

- Pre-Tax Contributions — When you contribute to certain types of Retirement Plans (such as 401Ks or Traditional IRAs) those contributions typically occur 'pre-tax'. This column shows any of those contributions that create 'Tax Credits', which are displayed on the Grand Total tab.

- Tax Rate — The tax rate applied to Income for that year.

- Net (post-tax) Total Income — The total income amount after taxes.

2. Expenses Tab

This tab contains data relevant to the Expenses item table and displays the following columns:

- Age — Your age in the corresponding year.

- Year — The year corresponding to each row in the table.

- Expense Name — One column for each expense item, column headers correspond to expense's Name. The values shown are pre-tax amounts.

- Total Debt from Expenses — The total of amount of debt you have remaining from Expense items.

- Sourced Expenses — Total Expenses 'Sourced' directly from an account (configured by choosing a 'Source' from an Expense's properties).

- Total Expenses — Total Expenses from expense items. Does not included 'unsaved cashflow'.

3. Accounts Tab

Clicking Accounts displays subordinate tabs for each account defined in the Accounts & Taxes table along with an Account Totals tab. Selecting a subordinate tab displays details corresponding to that account in a tabular view on a year-by-year basis.

The contents of each subordinate data table varies somewhat, depending upon the terms relevant to a particular account type and its tax handling (i.e. whether it is a tax-deferred account or not). There are 3 account types outlined below:

The Default Account — Your Default Account is the top-most account in your account list and where your positive cashflow accumulates by default. This is also the account that receives dispersals such as RMDs or rollover funds from other accounts.

Tax-Deferred Accounts — This is any account with a tax type of either Tax-Deferred, Tax-Deferred (gains only), or Tax-Exempt. Typically, these are accounts like 401ks, 403bs, IRAs, etc. The gains in these accounts are not taxed until funds are withdrawn.

Annually-Taxed Accounts — This is any account with a tax type of tax-annual. Typically, these are accounts like checking, savings, or even brokerage accounts depending on trading frequency. These types of accounts can contain a mix of annually-taxed gains and deferred gains.

Account Data Columns

Based on the type of Account being displayed, relevant columns are displayed. Below are all possible columns for all Account types:

- Age — Your age in the corresponding year.

- Year — The year corresponding to each row in the table.

- Defined Contribution — The annual amount contributed to this account as specified on the Accounts & Taxes page.

- Miscellaneous Contributions — Contributions to this account resulting from either a rollover from another account or from funds drawn to cover negative cash flow.

- Contributions from Employer — Amount matched / contributed by your employer (only visible for Retirement Accounts such as 401k/403b/TSP).

- Contributions from RMDs — This column is unique to the default account. When RMDs are taken from tax-deferred accounts, they go into this account. This column shows the gross annual RMD amount being deposited.

- Taxes on RMDs — The taxes on the gross RMD amount.

- RMD — The annual 'Required Minimum Distribution' taken from this account and deposited in the 'Default Account'.

- Total Gains for Year — Annual gains based on account(s) '% Growth' defined.

- Annually-Taxed Amount — The amount of annual (short-term) gains that are taxed in that particular year.

- Taxes on Annual Gain — The annual taxes on the growth of taxable accounts(s).

- Total Tax-Deferred Gains — The total amount of tax-deferred gains that have accumulated in the account up to the particular year.

- Cashflow Contribution — The annual contributions to this account resulting from positive cash flows (i.e. the excess funds available whenever current income exceeds current expenses).

- Drawdown Withdrawal — Withdrawals from this account resulting from negative cash flow (i.e. the shortage of funds that must be accounted for whenever current expenses exceed current income).

- Rollover withdrawal — Withdrawals from this account associated with the rollover of funds to another account (note: a rollover occurs when the End Age of an account is reached).

- Early Withdrawal — Withdrawals from this account prior to the account owner reaching age 60.

- Early Withdrawal Penalty — The 10% tax penalty applied to any early withdrawals from this account.

- Taxes on Tax-Deferred Withdrawals — Total taxes on withdrawals from tax-deferred accounts (includes any Early Withdrawal Penalties). Does not include taxes on Required Minimum Distributions (RMDs), if RMDs are applicable.

- Remaining Principal — Displayed only for Home Equity accounts, this column shows the principal remaining on the loan (if one exists).

- Balance Adjustment — Withdrawal of funds to source another account's Starting Balance.

- Inflation Devaluation — This term applies whenever the data is shown in today’s dollars and is the effective loss of purchasing power of the dollars in this account due to inflation.

- Balance (Start of Year) — The account balance at the start of the particular year.

- Balance (End of Year) — The account balance at the end of the particular year.

4. Drawdowns Tab

Unlike other tables that display data for each year, this table displays a row every time a drawdown from an Account occurs — as a result there could be multiple entries for some years, and for others, none at all. The following columns are displayed:

- Age — Your age in the corresponding year.

- Year — The year corresponding to each row in the table.

- Account — The name of the Account funds were drawn from.

- Amount — The amount of the drawdown.

- Purpose — Whether the drawdown was to cover negative cash flow in a given year, or for the purposes of making a defined contribution to another account.

- Criteria Met — Automatic drawdowns are made based on the order defined under Optimizing Withdrawals. This value reflects the matching preference criteria when the funds were drawn. The only exception to this is if you have defined a Negative Contribution for a given year — in that case 'Negative Contribution' appears.

5. Grand Total Tab

This table shows an integrated summary of all Income, Expense and Account items. The following columns are displayed:

- Age — Your age in the corresponding year.

- Year — The year corresponding to each row in the table.

- Gross (pre-tax) Total Income — The pre-tax total of all income streams.

- Other Contributions — Contributions that are not 'funded' from either Income or from another Account. For example, Equity in a home or rental property, Employer Contributions, Starting Balances of accounts that do not begin in year-1, additional contributions to a home equity account, or contributions to an account designated as 'unfunded' on its properties tab.

- Taxes on Income — Total taxes on income.

- Tax Credits — If you have pre-tax contributions, a credit is made to your 'Taxes on Income' based on the Income Tax Rate for the year.

- RMDs — Total RMDs from applicable tax-deferred account(s) (not used to calculate the 'Total' for the year since those funds are simply 'transferred' to the Default Account).

- Taxes on RMDs — The taxes on the gross RMD amount.

- Taxes on Tax-Deferred Withdrawal — Total taxes on withdrawals from tax-deferred accounts (includes any Early Withdrawal Penalties). Does not include taxes on Required Minimum Distributions (RMDs), if RMDs are applicable.

- Total Gains for Year — Annual gains based on account(s) '% Growth' defined.

- Taxes on Annual Gains — The annual taxes on the growth of taxable account(s).

- Expenses — Total Expenses for the year including 'unsaved cash flow' (does not include taxes).

- Income Tax Rate — The tax rate used to determine taxes on income and annual (short-term) gains.

- Gains Tax Rate — The tax rate used to determine taxes on tax-deferred (long-term) gains.

- Cashflow — The difference between annual post-tax income and annual (non-sourced) expenses (not used to calculate the Total since it is accounted for in the Income and Expense columns). NOTE: If 'Debt Reduction' is enabled, cash flow is decreased because debt reductions are considered Expenses.

- Funded Contributions — The amount of defined contributions that were actually made into your accounts (not used to calculate the Total shown only for informational purposes).

- Inflation Devaluation — This term applies whenever the data is shown in today’s dollars and is the effective loss of purchasing power of the dollars in this account due to inflation.

- Total Debt — The total amount of Debt from both Expense or Account (Home Equity) items.

- Total — The account balance at the end of the year. All columns except, RMDs, Funded Contributions, Cashflow, and Total Debt are used to calculate the Total. The following calculation is performed for each year:

Previous Year's Total

- + Gross (pre-tax) Total Income

- + Other Contributions

- - Taxes on Income

- + Tax Credits

- - Taxes on RMDs

- - Taxes on Tax-Deferred Withdrawals

- + Gains

- - Taxes on Annual Gains

- - Expenses

- - Inflation Devaluation

Note: The Total may be plus/minus a few dollars due to rounding multiple values for Today's versus Tomorrow's dollars.

- Tracked Progress — If you have entered Progress values, this is the progress amount at the end of the year.

- Progress Growth — If you have entered Progress values for the particular year, the percent increase/decrease from tracked Progress of the previous year.

- Variable Spending Approach — This is an informational column showing what your spending would be for a given year should you use a variable spending approach based on the amount of assets from the previous year. A common approach is to use 4%. If you would like a different amount displayed, go to Menu / Interface Options and change the "Default Variable Spending Approach" value.

6. Metrics for Year

This section displays a few interesting Metrics associated with the year you are currently in. The following are displayed:

- Annual Cash flow — The difference between annual post-tax income and annual (non-sourced) expenses. Does not include subtraction of funds for contributions defined to your accounts.

- Monthly Cash flow — The difference between post-tax income and (non-sourced) expenses. Does not include subtraction of funds for contributions to your accounts.

- Monthly Expenses — Annual Expenses divided by 12

- Monthly Contributions Made — Defined contributions to your accounts that were actually made (if there is no income or available funds, contributions are not made).

- Savings Rate — Percent of Income saved for the year. Calculated as Annual Cash flow divided by Total Post-Tax Income.

- Annual Gains — Total Gains earned for the year.

- Annual Taxes — Total Income Taxes paid for the year.

- Income Tax Rate — Income Tax rate for the year.

- 4% Spending — If you are considering using the '4% Rule', this is the amount you could spend in the year.

- Progress Growth (year-to-date) — Based on your year-to-date Progress, the percent increase/decrease from tracked Progress of the previous year.