Modeling Expenses

The Expense section is used to enter a variety of expenses such as:

- Vehicle payment

- Education

- Daycare

- Credit Card

- Mortgage

- Etc…

1. Adding Expenses

To add a new expense item, click on the plus sign next to the Expense Name

2. Modeling Expenses

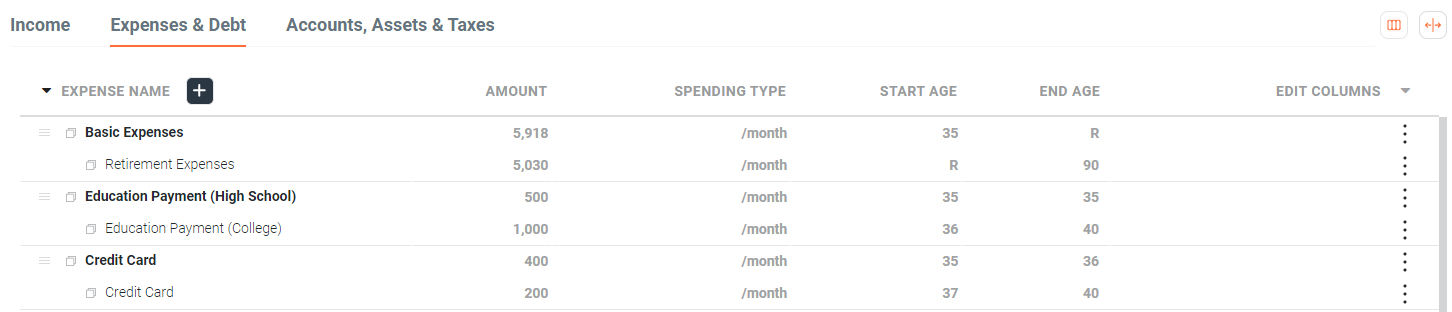

As with Income items, Expenses can be broken out into separate Start and End Ages. See the example below:

In this example, Education has been broken into two different age ranges. One for high-school and one for college. Also note that the Credit Card has been broken out into two different age ranges. This is due to the monthly payment being reduced starting at age 37.

Grouping Expenses (Available in Unlimited Plan Only)

For other types of expenses that you feel will not grow or shrink at a significantly different rate than others, it may make sense to lump these expenses into a single item. You can create an expense group by clicking on the icon next to the Expense Name.

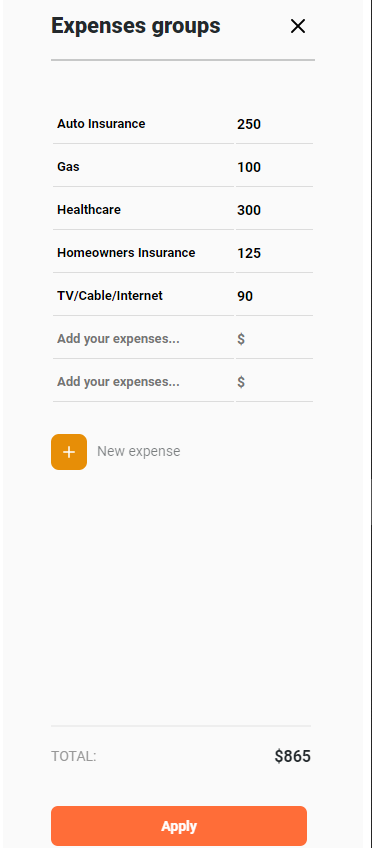

This will open the right rail window where you can enter as many expenses as you wish. The expenses of each item will be added up and listed as one line item under Expenses.

3. Spending Type

You can enter your expenses as either monthly or yearly spending types in the basic plan. For the unlimited plan, you can also enter your expenses as Percent Based Expenses (%) or Percent Based Variable Expenses (% Variable)

Percent Based Expenses (%)

Rather than define an expense as a fixed dollar amount (monthly or yearly), you may alternately base it on a percentage of your assets — the most famous approach being the '4% Rule' (popularized by the 'Trinity Study', although you can set any percentage you like in OnTrajectory).

Using this approach, the expense amount is determined on the Start Age of the expense based on total assets at the beginning of the year (plus inflation for that year) multiplied by the percentage entered. Thereafter, the expense amount increases with inflation, which can be overridden with the 'Growth Override' field. This means you could set 4% as your initial amount, but have the expense increase faster or slower than inflation. To define an expense in this way, choose "%" from the Spending Type dropdown — you can see the amount calculated in the Expense Output Data.

Percent Based Variable Expenses (% Variable)

A second approach is to apply the percentage each year, yielding a new variable amount for each year within the age range. By selecting "% variable" a new expense amount is calculated each year based on the assets at the beginning of the year (note that overriding inflation does not affect this type of expense as it is re-calculated each year based on current assets). Again, you can see the amount calculated in the Expense Output Data.

4. Expense Growth and Inflation (the Growth Override Field)

Growth Override specifies the rate at which an expense item is expected to grow. By default, expenses grow at inflation, however, you can override that rate by clicking the checkbox in this column to indicate a specific growth percentage. By default, On Trajectory uses 3% as the inflation rate. If you believe an expense item will simply keep up with inflation, there's no need to use the growth override %. However, if you feel a specific expense item will outpace inflation, enter 4% or greater in the growth override % field. Conversely, if you feel a specific expense will not grow with inflation, enter 2% or less in the growth override % field.

This field is useful for either 'freezing' a payment amount, such as for a mortgage or car payment you

currently have (i.e. set Override to 0%) — or for accelerating an expected rate increase, such as for

healthcare (which many believe will continue to increase above inflation).

NOTE: When setting an Expense (or Income) in the future, the amount will be inflated based on the

central Inflation Rate up to the "Start Age" for the item. Thereafter the Growth Override value will

be used.